How to use the NOMINAL function

What is the NOMINAL function?

The NOMINAL function calculates the nominal annual interest rate based on the effective rate and the number of compounding periods per year.

Table of Contents

1. Introduction

What is the difference between the NOMINAL function and the EFFECT function?

NOMINAL function calculates the nominal annual interest rate based on the effective rate without taking compounding into account.

EFFECT function calculates the effective annual interest rate based on the nominal rate factoring in the effect of compounding periods within the year.

Knowing both rates helps properly compare interest costs and earnings on loans and investments.

What is the effective annual interest rate?

The effective annual interest rate is the actual annual interest rate earned on an investment after accounting for compounding frequency.

What is the nominal annual interest rate?

The nominal annual interest rate, also known as the stated annual interest rate, is the rate of interest quoted on an investment or loan without accounting for compounding.

It does not consider compounding periods within the year, often stated as "per annum" or "per year". If interest compounds during the year, the effective annual rate will differ from the nominal rate.

What is the number of compounding periods per year?

The number of compounding periods per year refers to how often interest is compounded annually on an investment or loan.

Some common compounding periods:

- Annually - 1 compounding period per year

- Semiannually - 2 compounding periods per year

- Quarterly - 4 compounding periods per year

- Monthly - 12 compounding periods per year

- Weekly - 52 compounding periods per year

- Daily - 365 compounding periods per year

The number of compounding periods impacts the effective annual interest rate. More frequent compounding results in higher effective rates.

What is the math formula behind calculating the nominal interest rate based on the effective interest rate and the number of compounding periods?

Nominal rate = ((effective_rate +1)^(1/npery ) - 1)*npery

effective_rate: Effective interest rate

npery : Number of compounding periods

For example: Annually: 10% interest compounded annually: Effective rate = 10%

Monthly: 10% nominal interest compounded monthly: Effective rate = (1 + 0.10/12)12 - 1 = 10.47%

Daily: 10% nominal interest compounded daily: Effective rate = (1 + 0.10/365)^365 - 1 = 10.52%

The effective annual rate will exceed the nominal rate when compounding within a year.

2. Syntax

NOMINAL(effect_rate, npery)

| effect_rate | Required. The effective interest rate. |

| npery | Required. The number of compounding periods per year. |

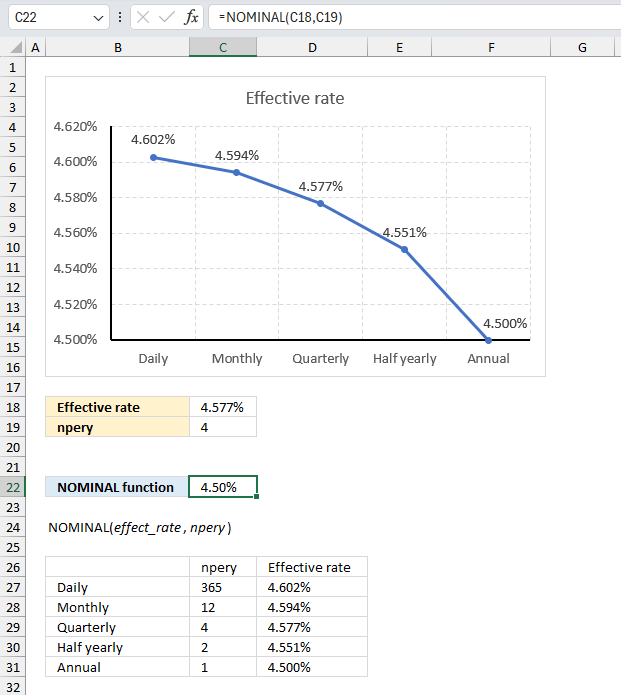

3. Example 1

A savings account offers an effective interest rate of 4.5765%, compounded quarterly. What is the nominal interest rate for this account?

Arguments:

- effect_rate: This is the effective interest rate. Use a decimal value, not a percentage.

- npery: This is the number of compounding periods per year. This must be a positive integer.

Formula in cell C22:

An effective interest rate of 4.577% compounded quarterly, the effect_rate would be 0.04577 (4.577% expressed as a decimal), and the npery would be 4 (4 quarters in a year). The formula in cell C22 returns a nominal interest rate of 4.5%

The chart above shows the effective annual interest rate for different compounding periods, they are daily, monthly, quarterly, half yearly, and yearly. For an annual interest rate of 4.5% the effective interest rate for:

- daily compounding is 4.602%

- monthly compounding is 4.594%

- quarterly compounding is 4.577%

- half yearly is 4.551%

- annual is 4.5%. This is the nominal rate.

The effective annual interest rate is calculated using the following formula:

Effective Annual Rate = (1 + nominal_rate/npery)^npery - 1

This gives the following formula for calculating the nominal rate:

Nominal rate = ((effective_rate +1)^(1/npery ) - 1)*npery

((0.04577+1)^(1/4)-1)*4 is approx 0.045 or 4.5%. This value matches the calculated value in cell C22.

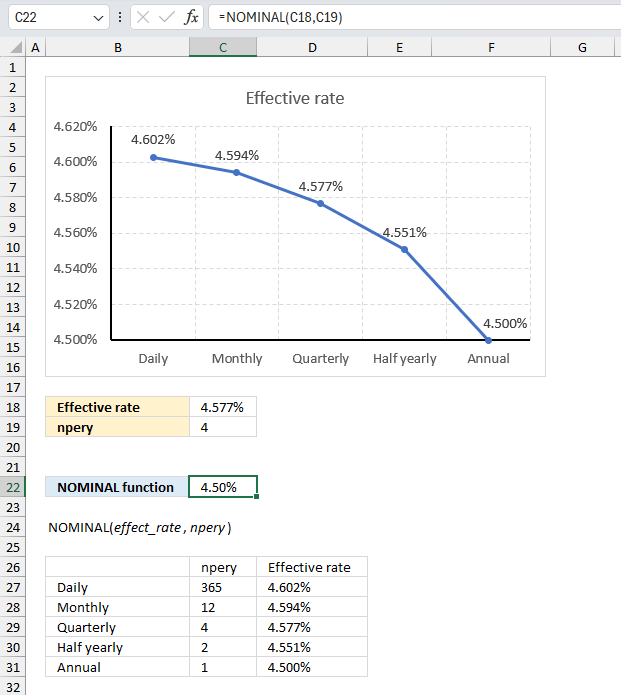

4. Example 2

An investment opportunity promises effective annual interest rate of 8.16% compounded semi-annually. Calculate the a nominal annual interest rate for this investment?

Arguments:

- effect_rate: This is the effective interest rate. Use a decimal value, not a percentage.

- npery: This is the number of compounding periods per year. This must be a positive integer.

Formula in cell C22:

An effective interest rate of 8.16% compounded half yearly or semi-annually, the effect_rate would be 0.0816 (8.16% expressed as a decimal), and the npery would be 2 (2 halves in a year). The formula in cell C22 returns a nominal interest rate of 8%

The chart above shows the effective annual interest rate for different compounding periods, they are daily, monthly, quarterly, half yearly, and yearly. For an annual interest rate of 8% the effective interest rate for:

- daily compounding is 8.328%

- monthly compounding is 8.300%

- quarterly compounding is 8.243%

- half yearly is 8.160%

- annual is 8.000%

The effective annual interest rate is calculated using the following formula:

Effective Annual Rate = (1 + nominal_rate/npery)^npery - 1

This gives the following formula for calculating the nominal rate:

Nominal rate = ((effective_rate +1)^(1/npery ) - 1)*npery

((0.0816+1)^(1/2)-1)*2 is approx 0.08 or 8%. This value matches the calculated value in cell C22.

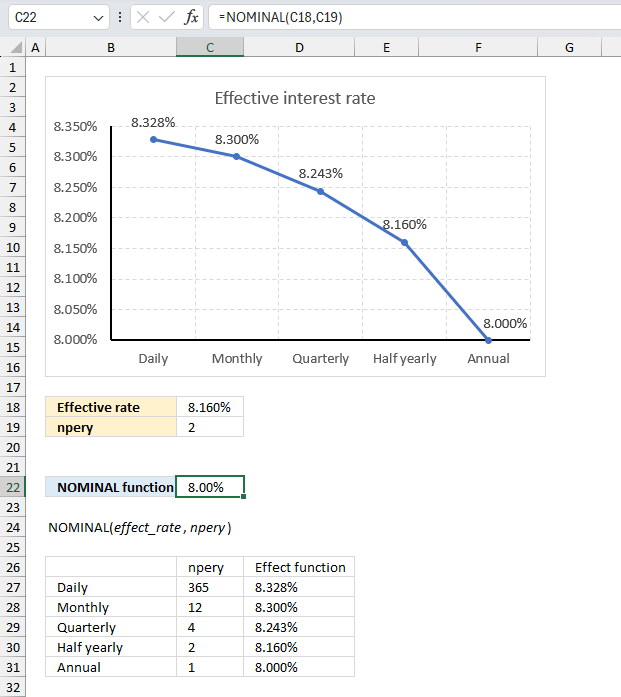

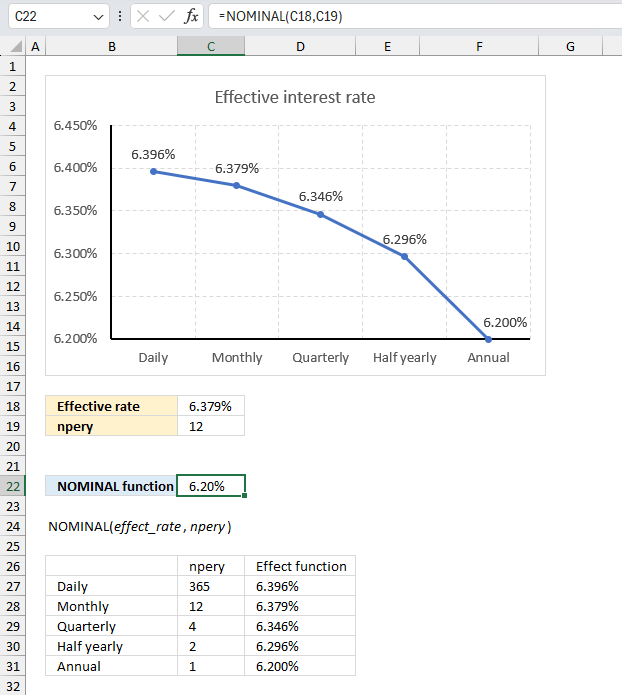

5. Example 3

A bond pays a stated effective coupon rate of 6.379%, with interest compounded monthly. Determine the nominal yield for this bond?

Arguments:

- effect_rate: This is the effective interest rate. Use a decimal value, not a percentage.

- npery: This is the number of compounding periods per year. This must be a positive integer.

An effective interest rate of 6.379% compounded half yearly or semi-annually, the effect_rate would be 0.06379 (6.379% expressed as a decimal), and the npery would be 12 (12 months in a year).

Formula in cell C22:

The formula in cell C22 returns 6.38% which represents the effective annual interest rate based of 6.2% compounded semi-annually.

The chart above shows the effective annual interest rate for different compounding periods, they are daily, monthly, quarterly, half yearly, and yearly. For a nominal interest rate of 6.2% the effective interest rate are with:

- daily compounding is 6.396%

- monthly compounding is 6.379%

- quarterly compounding is 6.346%

- half yearly is 6.296%

- annual is 6.2%

The effective annual interest rate is calculated using the following formula:

Effective Annual Rate = (1 + nominal_rate/npery)^npery - 1

This gives the following formula for calculating the nominal rate:

Nominal rate = ((effective_rate +1)^(1/npery ) - 1)*npery

((0.06379+1)^(1/12)-1)*12 is approx 0.062 or 6.2%. This value matches the calculated value in cell C22.

6. What if the function is not working?

The NOMINAL function returns:

- #VALUE! if an argument is not a numerical value.

- #NUM! if effect_rate is smaller than 0 (zero) or if npery is smaller than 1.

The npery argument is automatically converted to a whole number by removing the decimals.

The NOMINAL function is related to the EFFECT function.

Functions in 'Financial' category

The NOMINAL function function is one of 27 functions in the 'Financial' category.

How to comment

How to add a formula to your comment

<code>Insert your formula here.</code>

Convert less than and larger than signs

Use html character entities instead of less than and larger than signs.

< becomes < and > becomes >

How to add VBA code to your comment

[vb 1="vbnet" language=","]

Put your VBA code here.

[/vb]

How to add a picture to your comment:

Upload picture to postimage.org or imgur

Paste image link to your comment.

Contact Oscar

You can contact me through this contact form