How to use the PDURATION function

What is the PDURATION function?

The PDURATION function calculates how many periods required by an investment to reach a given amount based on a percentage rate. It stands for period duration.

Table of Contents

1. Introduction

What is an investment?

An investment is an asset or business acquired with the goal of generating income or appreciation, the purpose is to grow the money over time.

What are periods?

A payment period is the length of time between payments made on a loan or investment. For example, a loan with monthly payments the payment period would be one month. A loan with quarterly payments the payment period would be three months.

What is present value?

The present value is the initial amount that will earn interest/dividend.

What is future value?

The compounded amount after the calculated periods based on the given rate. It measures what a current capital (present value) amount will be worth at a designated future date.

What is the difference between the PDURATION function and the NPER function?

The PDURATION focuses on the time needed for an investment to reach a specific value based on only accrued interest, while NPER function calculates the number of periods required based on payment, interest, present value and/or future value.

PDURATION(Rate, Pv, Fv)

NPER(rate, pmt, pv, [fv], [type])

What is the math formula for this particular function?

The following math formula calculates periods needed for an investment to grow to a future value.

Periods = (log(Fv)-log(Pv))/log(1+r)

Fv - Future value

Pv - Present value

r - rate

The LOG function calculates the logarithm of a number to a specific base.

Function syntax: LOG(number, [base])

Related functions

| Function | Description |

|---|---|

| RATE(nper, pmt, pv, [fv], [type]) | Returns the interest rate per period of an annuity |

| PV(rate, nper, pmt, [fv], [type]) | Returns the present value of an investment. |

| FV(rate, nper, pmt, [pv], [type]) | Returns the future value of an investment. |

2. Syntax

PDURATION(Rate, Pv, Fv)

| Rate | Required. Rate is the interest rate per period. |

| Pv | Required. Pv is the present amount of the investment. |

| Fv | Required. Fv is the desired future amount of the investment. |

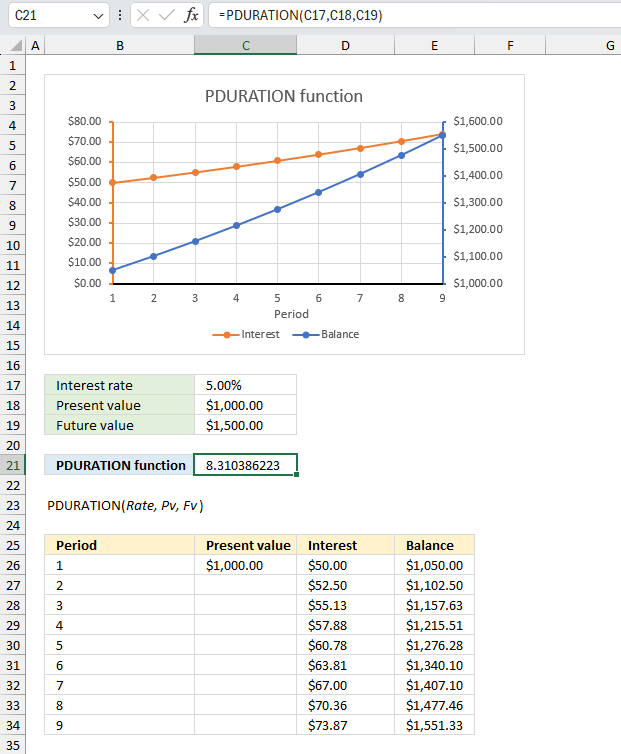

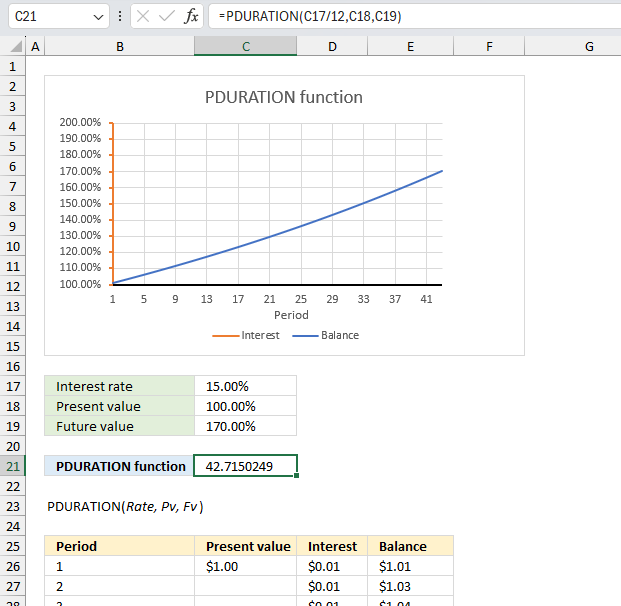

3. Example 1

How many years will it take for an $1,000 investment with a yearly interest rate of 5% to grow to $1,500?

The image shows a spreadsheet with a chart and table demonstrating the PDURATION function, it calculates the number of periods needed for an investment to grow an interest-bearing present value to a specified future value over time.

The arguments for this function are:

- Rate: The interest rate (5.00% in this example)

- Pv: The present value ($1,000.00 in this example)

- Fv: The future value ($1,500.00 in this example)

The chart plots the Interest and Balance over a 9-period duration, showing how the Interest accrues and the Balance grows from the present value to the future value.

The table shows the calculated values for each period, including the Present Value, Interest earned, and Balance (which is the Present Value + Interest) for that period.

Formula in cell C21:

The formula result shown is 8.3 in cell C21, which represents the number of periods required to reach the future value of $1,500.00 from the present value of $1,000.00 at the given interest rate of 5.00%.

To calculate the number of periods mathematically we can use the following formula:

Periods = (log(Fv)-log(Pv))/log(1+r)

Fv = future value

PV = present value

r = interest rate

Lets plug the values in this example into the math formula:

(log(1500)-log(1000))/log(1+0.05) = 8.31038622252056 which matches the value in cell C21.

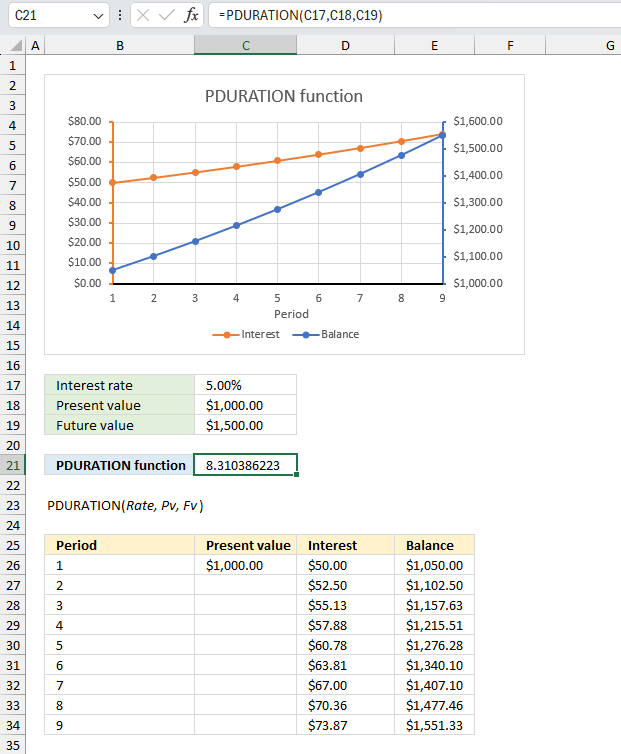

4. Example 2

A company makes a 80,000 investment that returns an annual interest rate of 10%, calculate how many months it takes until the accrued value reaches 90,000?

The image shows a spreadsheet with a chart and table demonstrating the PDURATION function, it calculates the number of periods needed for an investment to grow an interest-bearing present value to a specified future value over time.

The arguments for this function are:

- Rate: The interest rate (10.00% in this example)

- Pv: The present value ($80,000.00 in this example)

- Fv: The future value ($90,000.00 in this example)

The chart plots the Interest and Balance over a 15-period duration, showing how the Interest accrues and the Balance grows from the present value to the future value.

The table shows the calculated values for each period, including the Present Value, Interest earned, and Balance (which is the Present Value + Interest) for that period.

Formula in cell C21:

The formula result shown is 14.2 displayed in cell C21, which represents the number of months required to reach the future value of $90,000.00 from the present value of $80,000.00 at the given interest rate of 10.00%.

To calculate the number of periods mathematically we can use the following formula:

Periods = (log(Fv)-log(Pv))/log(1+r)

Fv = future value

PV = present value

r = interest rate

Lets plug the values in this example into the math formula:

(log(90000)-log(80000))/log(1+0.1/12) = 14.1927743418388 which matches the value in cell C21.

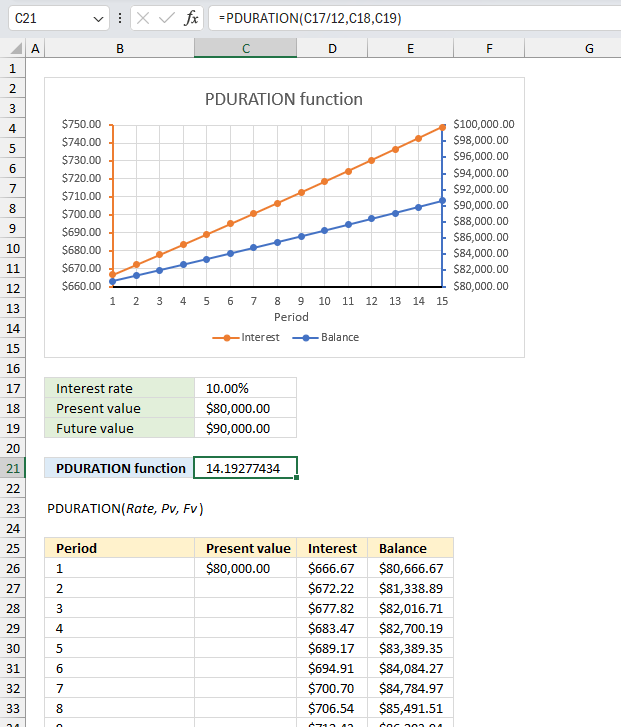

5. Example 3

An organization wants to know how many months it will take for an investment to grow 70% with an annual interest rate of 15%?

The arguments for the function are:

- Rate: The interest rate (15.00% in this example)

- Pv: The present value (1 in this example)

- Fv: The future value (1.7 in this example)

Formula in cell C21:

The formula result shown is 42.7 displayed in cell C21, which represents the number of months required to reach the future value 70% larger than the present value at the given interest rate of 15.00%.

The chart plots the Balance over a 43-period duration, showing how the Balance grows from the present value to the future value in percentages.

To calculate the number of periods mathematically we can use the following formula:

Periods = (log(Fv)-log(Pv))/log(1+r)

Fv = future value

PV = present value

r = interest rate

Lets plug the values in this example into the math formula:

(log(1.7)-log(1))/log(1+0.15/12) = 42.715024900246 which matches the value in cell C21.

6. What to do if the function is not working?

The function returns

- #VALUE error if invalid data types are used.

- #NUM error if argument values are invalid.

Positive values are required as arguments.

Functions in 'Financial' category

The PDURATION function function is one of 27 functions in the 'Financial' category.

How to comment

How to add a formula to your comment

<code>Insert your formula here.</code>

Convert less than and larger than signs

Use html character entities instead of less than and larger than signs.

< becomes < and > becomes >

How to add VBA code to your comment

[vb 1="vbnet" language=","]

Put your VBA code here.

[/vb]

How to add a picture to your comment:

Upload picture to postimage.org or imgur

Paste image link to your comment.

Contact Oscar

You can contact me through this contact form